8 questions about holiday rentals in Portugal

![]()

This article is intended for owners or future owners of real estate in Portugal who wish to rent out their property on a seasonal basis(known as “alojamento local” in Portugal). In recent years, Portugal has seen a boom in tourism, and seasonal rentals have multiplied. Many of you are asking us questions on this subject, but before getting started it’s important to know the procedures, laws, taxes… This article: “8 questions about holiday rentals in Portugal” will try to answer some of the most frequently asked questions about Alojamento Local.

It’s important to remember that everything to do with laws, taxes, procedures, etc. is open to interpretation. There’s a lot of information on the Internet, and sometimes it’s not easy to understand it all. What’s more, there are many specificities that depend on each individual case.

By choice, I wanted to write a “simple” article, without going into too much detail, to make it easier to read and give you a first level of information. So I’ll be taking a few “shortcuts”, and many points will be explained in outline. Some questions will be illustrated by graphics, as I believe that visuals sometimes help to better understand certain mechanisms, and the article will include numerous links, identifiable by the color “blue”. You’ll be able to click on these links, which will direct you to documents and sites that may be useful to you. Please note that the information contained in this article has been validated by Maitre Katia Neves, tax lawyer, to ensure its quality.

Finally, as I said earlier, everyone’s case is different. So I strongly recommend that you contact a tax specialist if you need more details. If you would like to be put in touch with a professional in this field, you can make your request here.

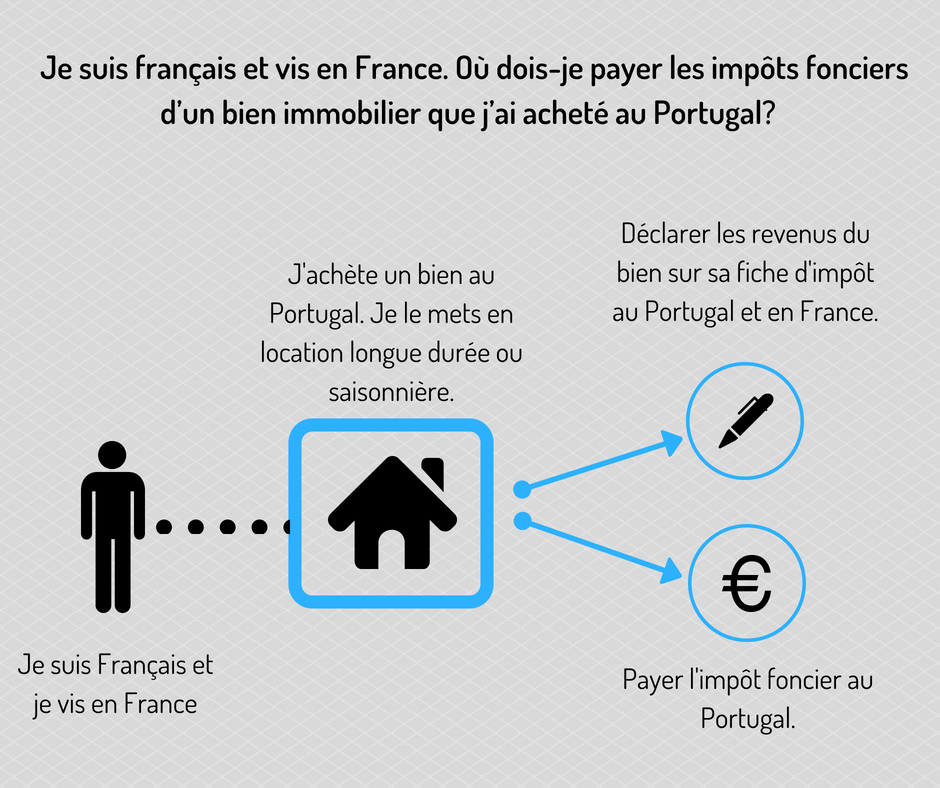

Question 1: I’ve bought a property in Portugal and rented it out. Where do I pay property tax on the income from this property?

Property taxes on income received in Portugal must be declared and paid in Portugal. A property you buy in Portugal will therefore be taxed in Portugal and exempt in your country of origin (provided that a tax treaty has been established between your country of origin and Portugal, as is the case for France, Belgium and Switzerland in particular) .

However, you must still declare the income from this property in your home country as “foreign income”. This is because, although you are exempt from tax in your home country on this property, the income from it will still enter into the calculation to determine the tax rate that will apply to income in your home country. What’s more, the value of your foreign assets will be taken into account when calculating the IFI (Impôt sur la Fortune Immobilière).

Question 2: How much tax do I have to pay on my rental income?

Assuming that your rental income is less than €200,000 a year, which will no doubt apply to you, you can choose between 2 different tax regimes:

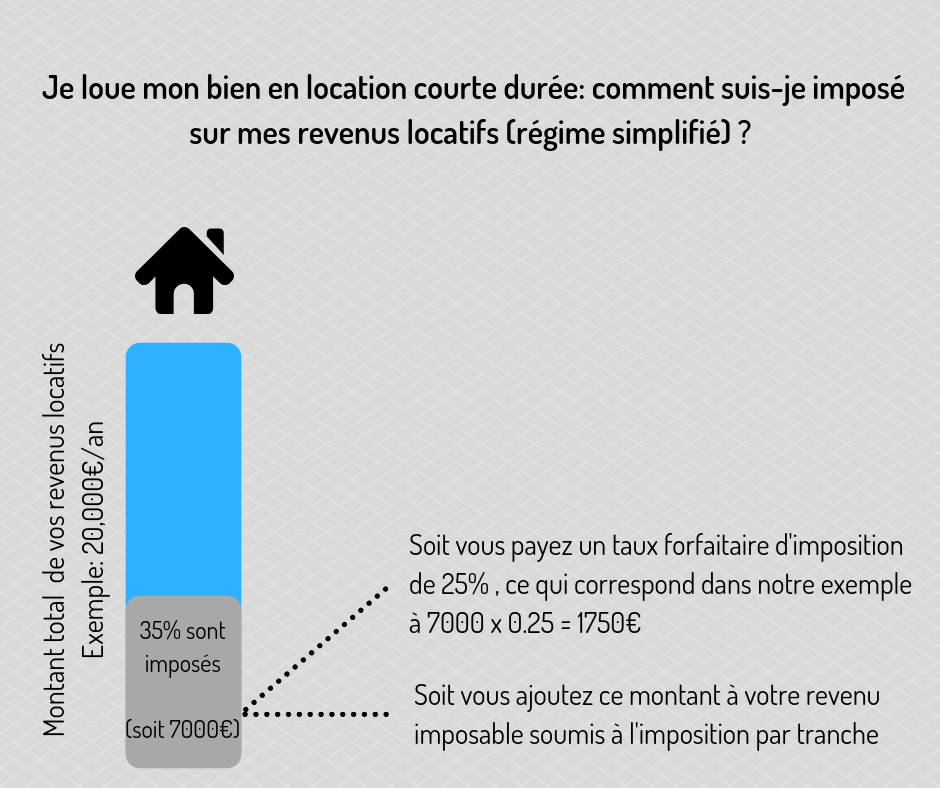

1. Régime particulier (also called “régime simplifié “), for those who want to rent out one or more of their properties on a seasonal basis without setting up a company to manage them :

In this case, you will be taxed on 35% of the value of your rental income. For example: if you earn €20,000 in rental income per year, only 35% of this €20,000 will be taxed, i.e. €20,000 x 0.35 = €7,000. Then, on this last amount, the 7,000€ in our example, you can choose toapply :

- either a flat tax rate of 25%, giving: 7,000€ x 0.25 = 1,750€ or

- or add this amount to your taxable income subject to bracketed taxation (see brackets in the next question).

2. Professional regime, for those who want to set up a company to manage their seasonal rental properties:

In this case, you are taxed on 100% of the value of the rental income by a flat-rate corporation tax of 21%. The advantage of this regime is that it allows you to deduct expenses related to the renovation of your property and rental expenses such as those mentioned below: (note that you can only deduct expenses if you are resident in Portugal. A resident of Portugal is a person who lives in Portugal for more than six months of the year and has his or her main economic interests in Portugal).

- Repairs (painting, floors, etc.)

- Renovations (installation of a new heating/air conditioning system, etc.)

- IMI (Imposto Municipal sobre a Transmissão, discussed later in this article)

- Insurance

- Condominium fees

- Management services

Please note: if your rental income exceeds €200,000 per year, you’ll need to set up a management accounting structure.

Question 3: What are the income tax brackets in Portugal?

Above, we talked about the possibility of choosing between flat-rate taxation on your rental income or taxation according to your tax bracket. Here are the tax brackets in Portugal(for income received in 2018).

Here’s an example: Imagine you have rental income of €30,000 per year in Portugal, and you’re in the bracket from €25,000 to €3,6856, i.e. a rate of 37% with an allowance of €3008.20. Your tax calculation would therefore be as follows:

- 30000€ * 0.37 = 11100€

- 11100€ – the 3008.20€ allowance = 8091.80€

Question 4: What taxes are payable in connection with the purchase and seasonal rental of my property?

At the time of purchase, you’ll have to pay the equivalent of “frais de notaire” in France. In Portugal, this corresponds to

- stamp duty (Imposto do Selo), which is 0.8% of the value of the property

- registry fees of €725

- transfer tax (IMT: Imposto Municipal sobre a Transmissão) of between 0% and 8% of the value of the property.

To calculate these “notary fees”, you’ll find a quick and easy simulator below

eachyear,you’ll also have to pay a tax called IMI(Imposto Municipal sobre Imóveis). IMI results from a rate of between 0.3% and 0.45%(2018 law), which is a rate set by each municipality and depends on the value of the property as estimated by the relevant town hall. You will receive an annual payment notice:

- either by bank transfer,

- at the Multibanco(cash dispenser) using the codes indicated on the payment notice,

- or by direct debit.

Tourist tax: Finally, when you rent a property, you’ll also have to pay a tourist tax(Taxa Municipal Turística)(also known as a “taxe de séjour“). This tax is paid to you by your traveler upon arrival at the accommodation. It is important that travelers are informed of the exact amount of the tax before booking. Once the tax has been collected, you pay it to the relevant town council. In Portugal, the tourist tax is currently €1 per person(aged over 13), per night, for up to 7 consecutive nights. From the 8th consecutive night onwards, no tourist tax is charged.

Question 5: How do I declare my property to start seasonal rental (Alojamento Local)?

Step 1 – Declare the start of your activity on the finance website (Autoridade Tributaria – AT). The activity code to choose for seasonal rental of furnished property is 55201 or 55204.

Please note:if you are not resident in a European Union country, you must have a tax representative in Portugal. If you are setting up a company, your accountant will take care of this. You’ll need a bank account in Portugal to open a business.

Step 2 – Register your property with the Town Hall where it is to be rented, or directly on the Portal do cidadão website. You will then be issued with a Local Alojamento Number. The following documents are required:

- a copy of the declaration of commencement of business made to the Finance Department (Autoridade Tributaria – AT) in step 1,

- a copy of your identity card and/or passport,

- a copy of the “Carderneta Predial” of your property, which is given to you when you purchase a property in Portugal,

- the completed and signed registro form. Just click here to access.

If you’re not Portuguese and don’t have a “Cartão de Cidadão”, you won’t be able to complete step 2 directly online. You’ll need to go directly to the town hall with the documents listed above, or go through a lawyer.

Step 3: Once these steps have been completed, the Town Hall will visit your home within 1 month(in some cities, delays are often longer due to high demand). The purpose of this visit is to check that everything is in order(rules listed in the next question).

Cartão de Cidadão and card reader required to complete step 2 online. If you don’t have one, you’ll have to go directly to the town hall, or take the necessary steps through a lawyer.

Question 6: What rules do I need to follow to rent out my property on a seasonal basis (Alojamento Local )?

There are a number of rules that you and your property will have to follow in the Alojamento Local process:

- The property must be in “good condition” inside and out,

- The property must have access to running water, be connected to the public sewage system and have hot and cold water,

- The property must have good ventilation (windows, VMC, etc.),

- The property must be equipped with suitable furniture, equipment and utensils,

- The property must be equipped with a system to block out outside light (blinds, curtains, etc.), and doors that can be closed to give occupants privacy,

- The property must comply with hygiene and cleaning regulations,

- The property must have the “Alojamento Local” safety kit (between 75€ and 90€ depending on the size of the property), which includes

- a fire extinguisher

- fire blanket

- first-aid box

- phosphorescent signs with important information

- The dwelling must have

- an official paper claims book, which costs 19.86€

- since July 1, 2018, it is also mandatory to have an electronic claims book, the 25 claims format, here, costs 9.93€.

- The owner must communicate the entry and exit of foreigners on Portuguese territory to the SEF (Serviços de estrangeiros e fronteiras) This can be done on the SEF website after you have registered there,

- For each rental, the owner must fill in a receipt to be sent to the finance department via the finance website (Autoridade Tributaria – AT)(you have until the 25th of each month for receipts issued the previous month),

- The owner must communicate the co-ownership regulations to seasonal tenants if it’s an apartment.

Part of the safety kit that must be present in your short-term rental property.

Question 7: How can I rent out my short-term accommodation (Alojamento Local)?

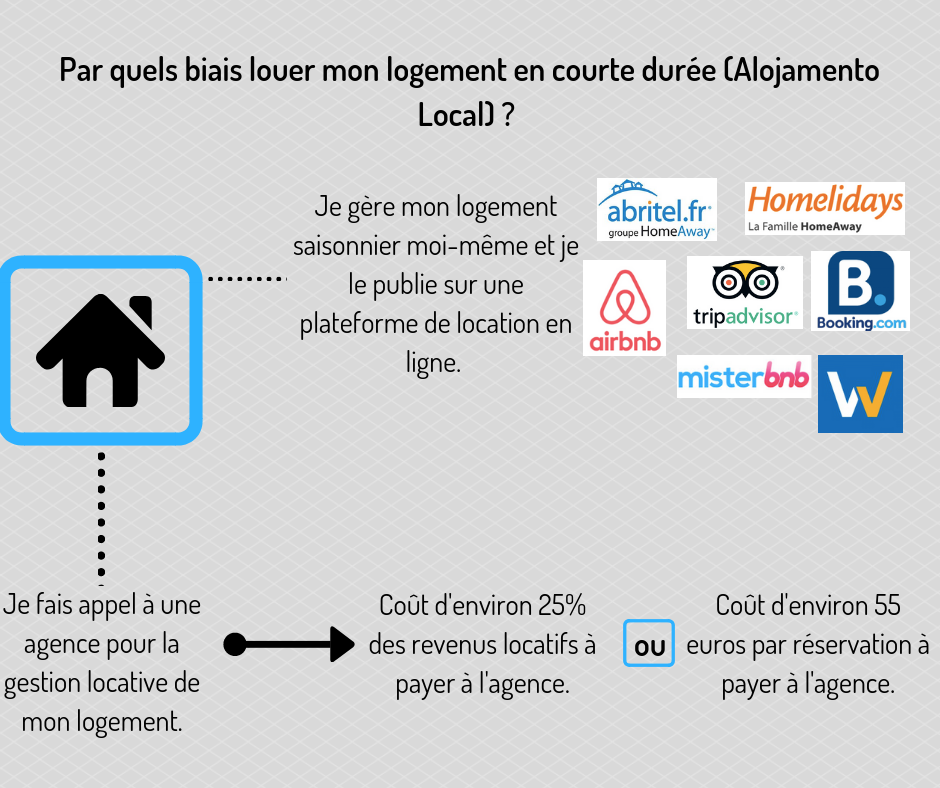

Once your property is ready for short-term rental, you’ll be spoilt for choice when it comes to advertising it via the many short-term rental websites that currently exist. Here is a non-exhaustive list of some of these sites, with their links:

You can also choose to use a rental management agency. There are many such agencies in Portugal, especially in the major cities. You should be aware that rental management fees, which include: check-ins, check-outs, cleaning, ad management, etc., are usually 25% of the rental income, or sometimes a fixed fee is charged, in which case they are usually around 55 euros per booking.

Question 8: What kind of rental return can I expect from my holiday rental property in Portugal?

When embarking on a rental investment project, the question of the return on this investment inevitably arises. To give you an idea, I invite you to run a simulation using the tool below, available by clicking on the button. This will give you an idea of your rental yield.

In conclusion

Short-term rental has become a popular option for property owners in Portugal. However, there are a number of formalities involved. You need to study the project carefully, and be aware of the laws, steps and duties involved in this type of rental. In addition, please note that the administrative procedures for local alojamento are often in Portuguese, so a good command of the language is recommended, or you may wish to consult a lawyer.

ready toembark on a short-term rental experience in Portugal?

If you liked this article, please click on the “Like” button below. And don’t forget to follow us on our social networks: our Facebook group “Amoureux du Portugal”, our Facebook page “Vivre au Portugal” and our Instagram “Vivre au Portugal”.

Receive our latest blog posts and our selection of properties for sale every month

* mandatory fieldFirst name * *Last name Telephone E-mail address * *Current city of residence Focus: *

- Buying a property in Portugal

- Renting a property in Portugal

- Nothing special in mind

Date of arrival in Portugal How can we help you? * * Please contact me:*

- Quickly please

- Later please

Region of interest *

- Almada

- Aroeira

- Seixal

- Setubal

- Other

You can view our Privacy Policy and Termsand Conditions here

Articles Populaires

dernières annonces

Single-storey house with swimming pool

Just a few meters from the magnificent bay of São Martinho do Porto, lies this…

Condominium apartments facing the sea

São Martinho do PortoBeautiful apartments in São Martinho do Porto “Janela da Baía”! Located in the heart of…

Villa already finished and ready to move in: 4-suite bungalow on 750m2 plot in a quiet area of Azeitão

Rua de ParisHouse already finished and ready to move into! Close to shops and services, quick access…

Magnificent house with basement, indoor and outdoor pool in Verdizela/Aroeira

Verdizela/AroeiraNew turnkey project: magnificent single-storey villa, 498m2 in surface area, high-end finishes on a 1875m2…

Goodwill 200m from the beach and 10km from Lisbon!

If you’re looking for a pastry shop / restaurant, fully equipped and close to the…

This T3 apartment in the private Jardim dos Navegantes condominium offers security and privacy.

parque lusoThe condominium offers a large swimming pool, a gym and a magnificent garden with pond…

Luxury apartment on the edge of a nature reserve

Your modern, spacious apartment between the beach and Lisbon’s capital. – Beach 5min – Golf…

If you’re looking for a fully equipped café/tea room close to the beach, you’ve come to the right place!

Business in full operation, includes the establishment’s customer portfolio and takeaway service, with a total…

House T3 1 10 min from Lisbon and 5 min from the beaches

PêraREADY TO MOVE IN! New T3 1 ready-to-live-in house in a quiet, rural neighborhood with…

Inscrivez-vous à notre newsletter

Recevez chaque mois les derniers articles de notre blog "la vie au Portugal" et notre sélection de biens immobiliers à vendre.