How to earn money and cars with your expenses in Portugal?

![]()

“Quer contribuinte na fatura?” You’ll soon be familiar with this question, which is systematically asked when you pay in Portugal: in restaurants, when shopping, in stores… In short, everywhere!

This question is asked to find out if you want your “numero de contribuinte ” (the famous Portuguese tax number also known as “NIF ” which I often talk about, particularly in this article) to be mentioned on your invoice/checkout slip.

This measure was introduced in 2013 by the Portuguese government to combat tax evasion and the black market. Tax benefits were introduced to encourage Portuguese consumers to request an invoice with their NIF.

1 – Why give your NIF when you spend in Portugal?

1. To benefit from a tax credit :

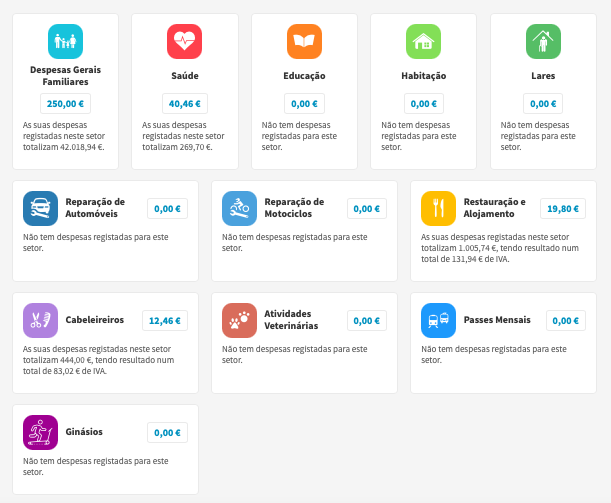

The main reason to give your NIF when shopping in Portugal is to benefit from tax reductions based on your spending. You can reclaim up to €250 per category of expenditure. There are different categories of expenditure in Portugal, for example “catering”, “health”, “transport”, “leisure”, “education”, “hairdresser”..

Existing expense categories

there are maximum tax refund amounts per category. Once the ceiling has been reached, you cannot claim a higher refund in the category in question. The category called “Despesas Gerais Familiares” (general family expenses) is where all “general” expenses go, so the ceiling is often reached fairly quickly, but you can easily move your purchases to other categories later on. For example, if you spend money in supermarkets, you can move them to the “Restauração” (catering) category. This will give you up to €250 in additional tax refunds.

After a whole year, the amount recovered can be substantial, and will be deducted from your tax bill. If you accumulate expenses in different categories, you can expect to earn up to €1,000. Given that taxes in Portugal are deducted at source, you may well find that the government gives you money back as a result of the spending you’ve done throughout the year. So spend! 🙂

2. Win the tax lottery:

Also, to encourage people to ask for a bill and combat the black market, the Portuguese government is holding prize draws via bill numbers . Yes, you read that right… tax lotteries! They call it “fatura da sorte” (the lucky bill). Invoices are drawn at random and the winners receive cash or cars.

The tax authorities award 1 “fatura da Sorte” ticket for every €10 spent. Example: if you spend 80€, you’ll receive 8 “fatura da Sorte” tickets.

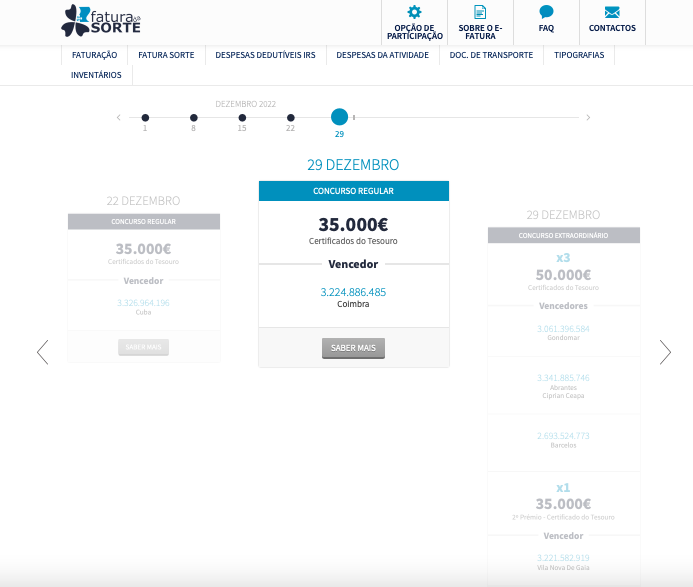

The “fatura da Sorte” provides for 1 draw per week, called the “regular draw”, and 2 draws per half-year (between June and December) called the “extraordinary draw”. The results of the draws are published on the Portuguese tax website in the “Fatura da sorte” section.

Tax site with announcement of December 29 winner

2 – How do I know if my expenses in Portugal are properly recorded and qualify for a tax credit?

Normally this is done automatically. You give your contribinte number every time you make a purchase, and your expenses in Portugal are then recorded. But in practice, when you give your tax number (NIF) to the merchant or service provider, this does not mean that your invoice is automatically validated. It’s important to check that your invoices are registered on the tax website (Portal das finanças).

1. Check that your expenses in Portugal are registered on the Portuguese tax site:

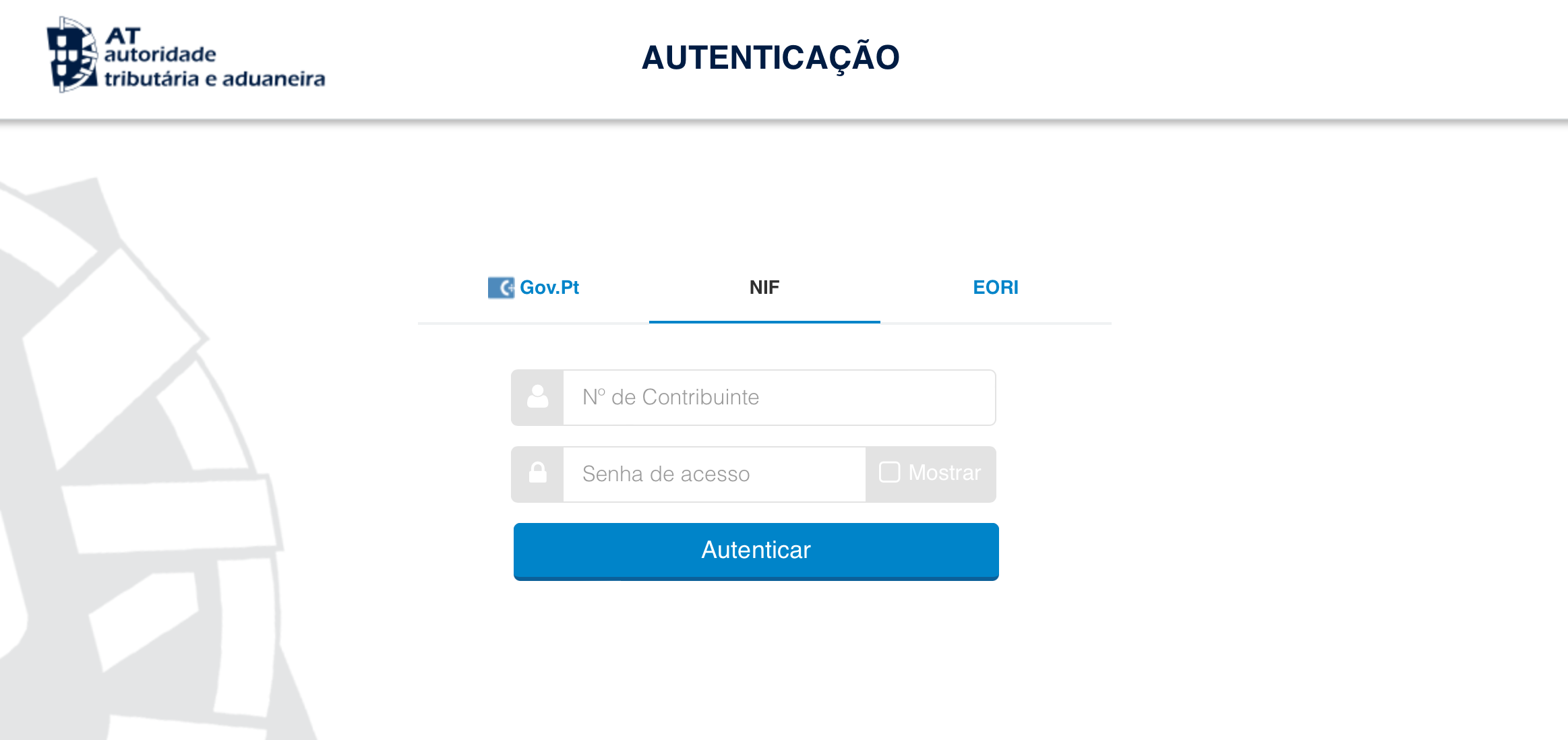

To check that your invoices are registered, go to the Portuguese tax site www.portaldasfinanças.pt, log in and access the electronic invoicing area. To do this, you need to :

- Click on “Iniciar sessao” then enter your NIF and password on Portal das Finanças,

- In “Serviços Frequentes“, click on “E-faturas”,

- Then “Verificar Faturas” at the bottom,

If not all your invoices are registered, you can register them yourself.

Connect to the Portuguese Finance website

2. Register your invoices on the Portuguese tax site:

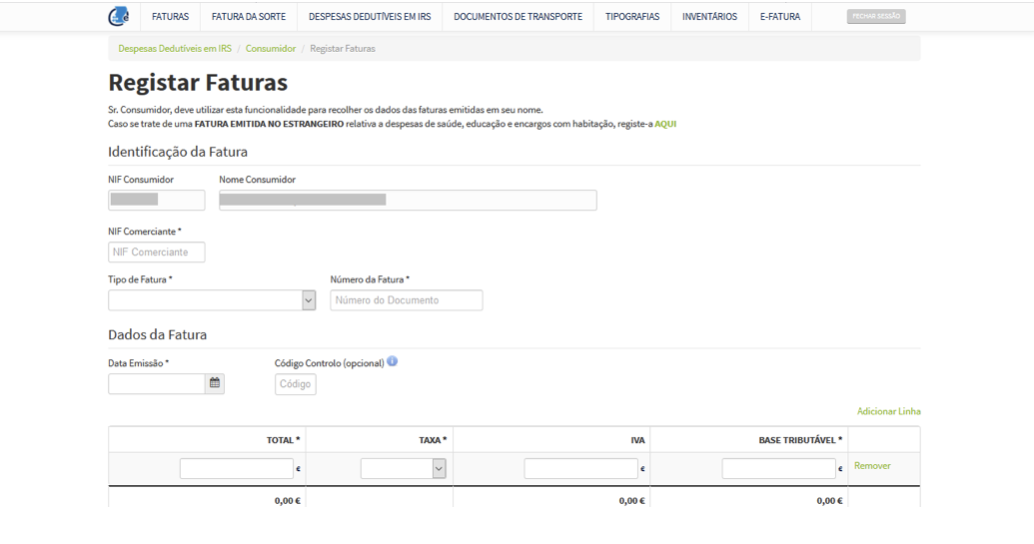

- Click on “Iniciar sessao”, then enter your NIF and password on Portal das Finanças,

- In “Serviços Frequentes”, click on “E-faturas”,

- Then“Registar Faturas” at the bottom,

- A page will open with your NIF and full name,

- Fill in your invoice details,

- Click on“registrar” once you’ve filled in all the fields.

Register an invoice

In conclusion

The use of the NIF is ubiquitous in Portugal, both for your expenses in Portugal, as you will have seen in this article, and for any formalities you may wish to carry out in Portugal. In fact, obtaining your NIF is the number 1 administrative formality you need to complete if you want to settle in Portugal. Contact us and we’ll help you with the formalities. I’ll tell you more about it in this blog post.

Join us on social networks!

- Facebook group “Amoureux du Portugal”,

- Vivre au Portugal” Facebook page

- Instagram ” Living in Portugal

Articles Populaires

dernières annonces

2 bedroom apartment with sea view, 10km from Lisbon and 2km from the beaches

Rua da Bica, 103Discover this magnificent 2 bedroom apartment with views of Arriba Fóssil and the sea, 2km…

Duplex apartment with sea view 15 minutes from Lisbon

rua Santa Teresa 7Bedroom + duplex apartment with sea view and 15 minutes from Lisbon.

Single-storey house with swimming pool

Just a few meters from the magnificent bay of São Martinho do Porto, lies this…

Condominium apartments facing the sea

São Martinho do PortoBeautiful apartments in São Martinho do Porto “Janela da Baía”! Located in the heart of…

Villa already finished and ready to move in: 4-suite bungalow on 750m2 plot in a quiet area of Azeitão

Rua de ParisHouse already finished and ready to move into! Close to shops and services, quick access…

Magnificent house with basement, indoor and outdoor pool in Verdizela/Aroeira

Verdizela/AroeiraNew turnkey project: magnificent single-storey villa, 498m2 in surface area, high-end finishes on a 1875m2…

House T3 1 10 min from Lisbon and 5 min from the beaches

PêraREADY TO MOVE IN! New T3 1 ready-to-live-in house in a quiet, rural neighborhood with…

4 bedroom villa with pool and jacuzzi in Aroeira

rua são miguelModern, minimalist architect-designed house with exceptional details in a quiet location in Aroeira 2-storey house…

House with pool ready to move into

Verdizela/Aroeira

Inscrivez-vous à notre newsletter

Recevez chaque mois les derniers articles de notre blog "la vie au Portugal" et notre sélection de biens immobiliers à vendre.