Buying property in Portugal: the steps you need to take

Are you ready? Want to buy real estate in Portugal? Want to own your own home in Portugal? Buying property in Portugal is a fantastic project that involves a number of different stages. Research, credit, making sure you have all the necessary documents… Buying a property in Portugal therefore requires preparation, and it’s important to be accompanied, especially if you don’t speak Portuguese.

In this article, I share with you some of the steps you need to take to buy your home in Portugal. Please note that I have deliberately simplified the following steps, and that it is still essential to be accompanied by a real estate advisor and/or lawyer when buying property in Portugal.

1- THE KEY PLAYERS FOR YOUR PROPERTY PURCHASE IN PORTUGAL

> THE REAL ESTATE CONSULTANT – to help you in your search, but not only ..

There’s no shortage of real estate agents in Portugal. However, there are several things I would recommend:

- choose an agency / person with an AMI number (real estate license – Atividade de Mediação Imobiliária).

- choose an experienced agency/person who has been on the real estate market for several years (ideally more than 5).

- choose an agency/person who specializes in the region you’re interested in. Their knowledge of the area may guide you to neighborhoods you might not have thought of.

- choose an agency/person who speaks your language to avoid misunderstandings and simplify your exchanges.

- choose a“real estate advisor” rather than an agent, as the latter will go beyond the simple search for properties. Like a real estate agent, he or she will first of all identify your needs and define your search criteria, help you in your research and also guide you through the administrative formalities once you’ve found the property and make sure you have all the necessary documents (which we’ll talk about a little later in this article).

> THE LAWYER – to make sure you have all the legal documents relating to the property

The services of a specialized lawyer are not compulsory, but they will help you to :

- draw up the preliminary sales agreement in French and Portuguese, and be present with you on the day of the notarial deed,

- make a call for funds to your local bank, if necessary,

- check that taxes and charges are up to date,

- check that the property is in order,

- collect all the information you need from the property registry and the town hall,

- Etc.

> THE NOTARY – to authenticate your documents

In Portugal, the notary’s role is quite different from that in France, since he only authenticates the signatures on the final sales contract. It is compulsory to go before a notary or lawyer for the deed of sale in Portugal, known as the “Escritura”.

2- YOUR PROPERTY PURCHASE IN PORTUGAL IN 5 STEPS

1 > THE NIF – for all administrative formalities

For all administrative procedures in Portugal, including the purchase of property, you need a tax identification number(numero de contribuinte). I explain in detail what it is and how to obtain it in one of my latest blog posts: NIF IN PORTUGAL.

2 > CREDIT – to find out how much you have available to buy your home in Portugal

Portuguese banks lend foreigners around 70% of the value of the property for non-residents and up to 80% for tax residents. Simply apply for a loan at the bank of your choice. You’ll find a credit simulator here to give you an initial idea.

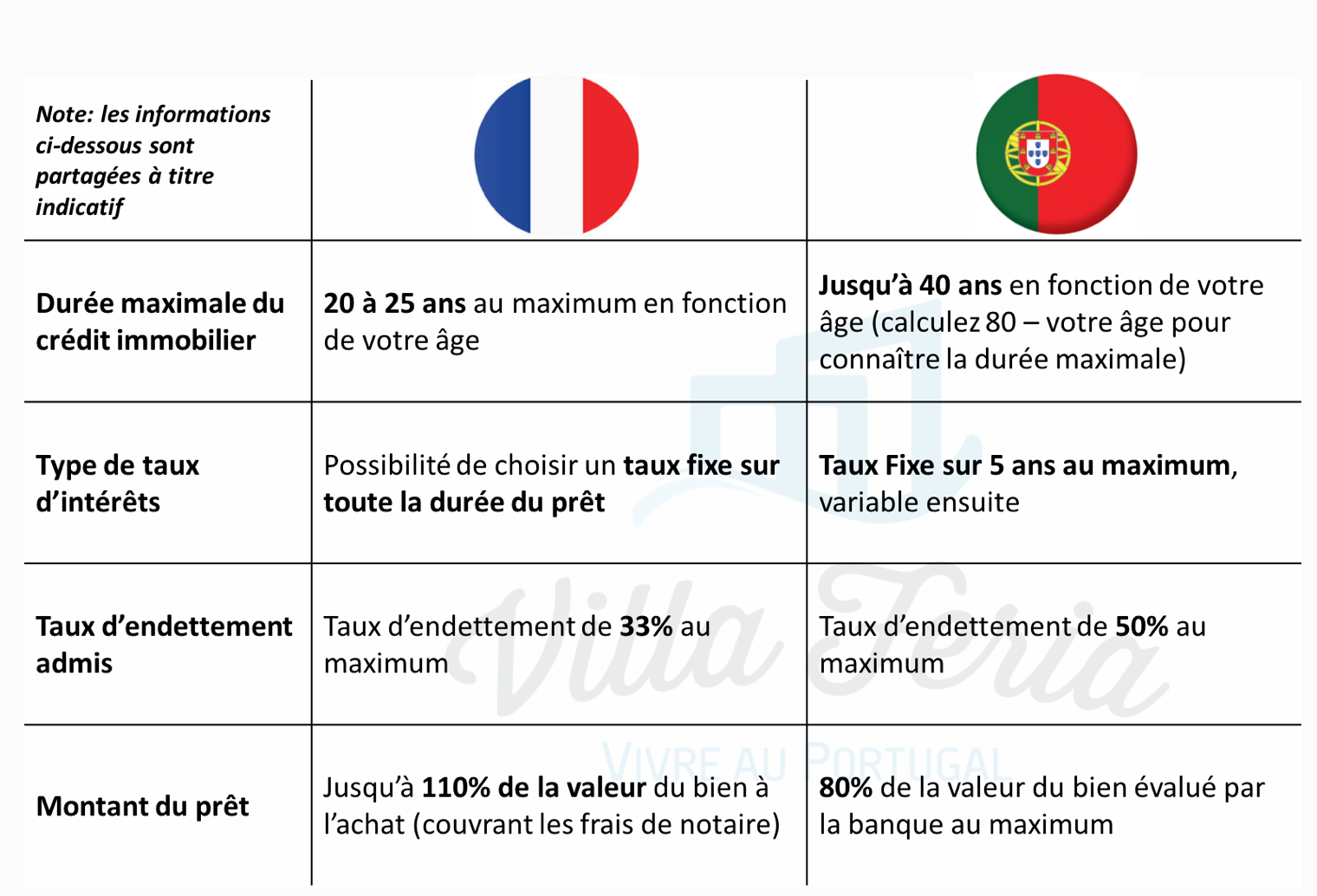

Here are a few indicative differences between credit in France and Portugal

3 > PROPERTY SEARCH – with or without a real estate agent/advisor

Most property searches are carried out via online real estate platforms such as idealista , or with exclusive products that only your real estate agent has

4 > THE COMPROMISE DE VENTE, known in Portugal as the “CPCV” (Contrato de Promessa de Compra e Venda) – to secure the property

Once you’ve found the right property, you’ll sign a compromis de vente. This is a binding contract between the 2 parties: buyer and seller. It’s a fairly detailed document, often more detailed than the final deed of sale (escritura).

If the seller defaults, he must pay double the deposit to the buyer. If the buyer defaults, he loses his deposit. The amount of the deposit varies, but on average ranges from 10% to 20% of the property. Your real estate advisor can help you negotiate/define the amount of the deposit. The CPCV is not compulsory, but is strongly recommended to secure the property.

The CPCV specifies the conditions of sale and the date for signing the deed of purchase (escritura) before the notary. On average, this date is 4 to 12 weeks after the signing of the compromis de vente

5 > THE DEED OF PURCHASE, known in Portugal as “escritura” – to sign the purchase definitively

The deed of purchase (escritura) is signed at the notary’s office. The notary ensures the legality of the transaction. All documents are checked and read aloud in Portuguese. The notary then registers the buyer as the new owner in the national register. The notary hands over the file to the buyer approximately 10 days after the escritura. If you don’t speak Portuguese, you’ll need a translator on site.

Escritura

3- DOCUMENTS TO REQUEST WHEN BUYING PROPERTY IN PORTUGAL

The following documents must be provided to you when purchasing a home in Portugal. Please note that the notary and/or the lawyer and/or the real estate advisor will ensure that you have these documents.

> CERTIFICATE OF TITLE known in Portugal as “Caderneta predial”

The owner is obliged to provide this document. This document certifies :

- the owner’s identity and tax number,

- property specifications: location, surface area, type of land, building surface area, number of rooms, materials used, taxable value of the property, etc

> TITLE OF OWNERSHIP called in Portugal “Certidão do Registo Predial” (or Certidão permanente)

The title deed is obtained from the Conservatória do Registo Predial and verifies whether the seller of the property is actually the owner.

> LICENCE D’HABITATION called in Portugal “Licença de utilização”

The licence d’habitation can be obtained from the town hall, which certifies that the property has been built legally and that it is shown on the urban development plans. If you’re buying a property built before 1951, you won’t need this permit.

> ENERGY CERTIFICATE

The energy certificate contains information on energy consumption. The certificate is valid for 10 years.

> TAX CERTIFICATE

To ensure that the owner has no debts and that the property is not mortgaged, pledged or rented out. You need to request a certificate from the Tax Office (finanças), which will certify that there are no further taxes to pay on the property.

> PLANS

Plans of the property you are about to buy. These are issued by the Mairie.

> TECHNICAL DATA SHEET called in Portugal “Ficha técnica”

The builder (property developer) issues this document. This is a new requirement for properties delivered after March 30, 2004, and shows the technical details of the property: suppliers, materials, etc.

> CAHIER DES CHARGES called in Portugal “Caderno de encargos”

Only if you’re buying a planned home. This document contains all the finishing touches that are included in the price of the turnkey project.

4- THE DIFFERENT COSTS

> THE AMOUNT OF THE PROPERTY: depending on the property you are buying

>LAWYER’S FEES: approximately 1.35% of the value of the property

>NOTARY FEES: between 1.5% and 3% of the purchase price

> REAL ESTATE AGENT FEES are included in the price of the house and paid by the seller (usually 5% of the price)

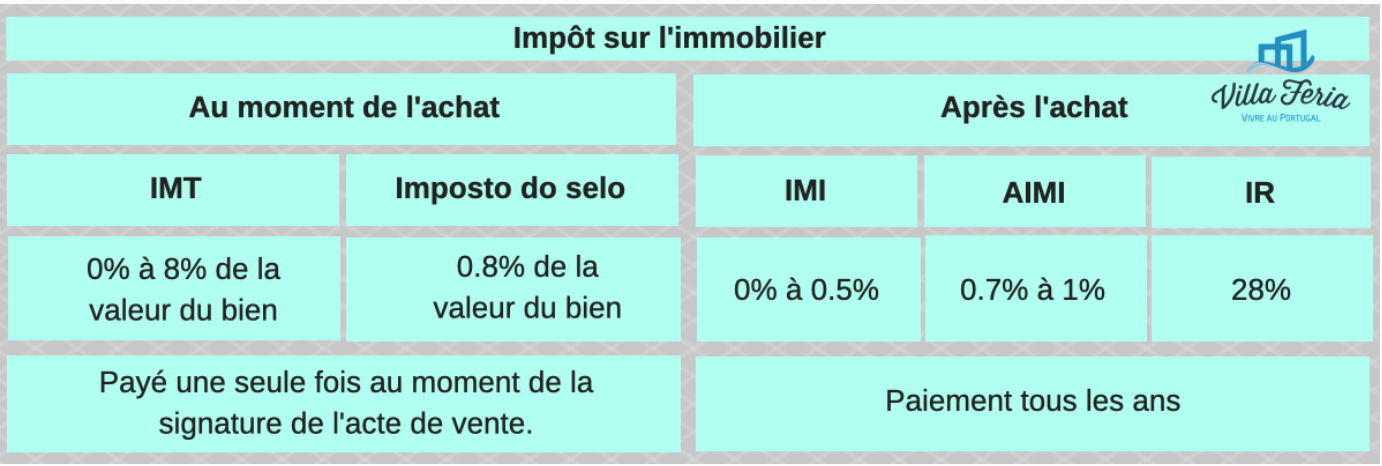

> PROPERTY PURCHASE TAX, known in Portugal as IMT (Imposto Municipal sobre a Transmissão Onerosa de Imóveis)

Before signing the contract, the IMT or municipal tax on financial transactions must be paid. This rate varies between 0% and 8% of the purchase price (the figures below are indicative and may vary slightly depending on your situation).

- Up to €92,407: 0.8%

- From €92,407 to €126,403: 2%

- From €126,403 to €172,348: 5%

- From €172,348 to €287,213: 7%

- From €287,213 to €574,323: 8% discount

- from €574,323: 6% of sales

To simulate your LMI, visit our notary fees simulator page.

The IMT must be paid before or at the time of signing the deed of sale at the notary’s office (usually by “multibanco” card, if you don’t have one – remember to ask in advance if a bank transfer is possible).

Details of the LMI in this blog article: Taxes in Portugal.

> STAMP DUTY called “Imposto de selo” in Portugal

The stamp duty rate is 0.8% of the sale value of the property, which is included in the deed of sale. You pay it only once when you buy a property. As with IMT, this tax must be paid before or at the time of signing the deed of sale at the notary’s office (usually by “multibanco” card, if you don’t have one – remember to ask in advance if a bank transfer is possible).

Details of stamp duty can be found in this blog article: Taxes in Portugal.

> REAL ESTATE TAX, known in Portugal as IMI (imposto municipal sobre imóveis)

Once you’ve purchased your property, you pay the IMI(imposto municipal sobre imóveis), the annual property tax payable by all happy owners. It is calculated on the property’s depreciated value, which generally represents between 80 and 90% of its market value.

It’s the equivalent of French property tax and taxe d’habitation combined. IMI is paid annually by property owners in Portugal. It is calculated on the basis of the property’s taxable value. The rate of IMI is set annually by the municipality where the property is located: generally between 0 and 0.5% of the value of the property.

Details on IMI in this blog article: Taxes in Portugal.

Property taxes in Portugal

In conclusion

As you can see, buying property in Portugal is not something to be taken lightly, and it’s always easier to get help with the administrative procedures involved in buying your property in Portugal. Here are a few other articles from the blog that may help you:

- Real estate in Portugal: 10 things to know before you buy

- Buying a wooden house in Portugal

- Let’s move to South Lisbon!

Join us on social networks!

- Facebook group “Amoureux du Portugal”,

- Vivre au Portugal” Facebook page

- Instagram ” Living in Portugal

Receive the latest blog posts and our selection of properties every month.

* required fieldFirst name * *Last name Telephone E-mail address * *Current city of residence Area of interest: *

- Buying a property in Portugal

- Renting a property in Portugal

- Nothing special in mind

Date of arrival in Portugal How can we help you? * * Please contact me:*

- Quickly please

- Later please

Region of interest *

- Almada

- Aroeira

- Seixal

- Setubal

- Other

You can view our Privacy Policy and General Terms and Conditions here

Articles Populaires

dernières annonces

2 bedroom apartment with sea view, 10km from Lisbon and 2km from the beaches

Rua da Bica, 103Discover this magnificent 2 bedroom apartment with views of Arriba Fóssil and the sea, 2km…

Duplex apartment with sea view 15 minutes from Lisbon

rua Santa Teresa 7Bedroom + duplex apartment with sea view and 15 minutes from Lisbon.

Single-storey house with swimming pool

Just a few meters from the magnificent bay of São Martinho do Porto, lies this…

Condominium apartments facing the sea

São Martinho do PortoBeautiful apartments in São Martinho do Porto “Janela da Baía”! Located in the heart of…

Villa already finished and ready to move in: 4-suite bungalow on 750m2 plot in a quiet area of Azeitão

Rua de ParisHouse already finished and ready to move into! Close to shops and services, quick access…

Magnificent house with basement, indoor and outdoor pool in Verdizela/Aroeira

Verdizela/AroeiraNew turnkey project: magnificent single-storey villa, 498m2 in surface area, high-end finishes on a 1875m2…

House T3 1 10 min from Lisbon and 5 min from the beaches

PêraREADY TO MOVE IN! New T3 1 ready-to-live-in house in a quiet, rural neighborhood with…

4 bedroom villa with pool and jacuzzi in Aroeira

rua são miguelModern, minimalist architect-designed house with exceptional details in a quiet location in Aroeira 2-storey house…

House with pool ready to move into

Verdizela/Aroeira

Inscrivez-vous à notre newsletter

Recevez chaque mois les derniers articles de notre blog "la vie au Portugal" et notre sélection de biens immobiliers à vendre.