Real estate in Portugal: 10 things to know before you buy

![]()

In a previous article dedicated to renting in Portugal, we saw that renting in Portugal is not so easy, but what about buying a property in Portugal? The language barrier, distance, market prices, local legal and tax specificities, etc. are just some of the difficulties you’ll encounter if you decide to buy a property abroad, in our case, a property in Portugal.

Buying abroad isn’t always easy, but it’s not impossible! Others have done it, why shouldn’t you? It’s important to remember that buying property is not something to be taken lightly. It’s an important step in your life, a financial investment, often linked to a loan, and therefore requires special attention. To help you, here is a non-exhaustive list of points to consider before buying a property in Portugal.

1. Choosing the right location for your property in Portugal

In real estate, we often talk about the importance of location, because it’s one of the most important aspects to consider. Even if you’re not buying with the intention of reselling, it’s important to ask yourself: “What if I were to resell? Would this location attract potential buyers? In principle, a good location allows the property to appreciate in value and generate added value.

So, when buying a property in Portugal, it’s essential to choose an area where it will be easy to resell. That’s why it’s important to take the time to discover the different regions available to you, then the cities in that region, and finally the neighborhoods in that city, before making a purchasing decision. Ask yourself several questions: is a region with high temperatures right for me? Is proximity to the sea essential? Would I prefer to live in a big city, a medium-sized town or in the countryside? Is rain a problem for me? Do I need to live near an airport? Is my budget in line with the region I want to live in? Etc.

It’s also a good idea to take a walk around the area around the property you’re interested in, to get a feel for the region and see what facilities and services are available nearby:

- Roads and freeways nearby,

- Public transport (airport, train station, bus stations),

- Supermarkets and stores,

- Schools and distance to work,

- Hospitals, etc.

Finally, with regard to the property itself, consider the following points: noise, neighbors, frequentation, sun exposure, etc.

Several articles on this blog are dedicated to different regions of Portugal. I invite you to consult them to get a first idea of some of these regions:The 4 best regions to live and invest in

5 reasons to move to the Lisbon region

Why live in northern Portugal?

2. Request documents and house plans

When buying property in Portugal, the notaire is not as “important” as in France. The notary’s main role is to intervene when the sale is signed. It’s up to you or a lawyer to check the land registry and title deeds…(If you’re taking out a bank loan, the bank will normally do the checking). However, there are a few points to bear in mind:

- Check that the property is free of seizures and mortgages. You can check this with the “Conservatória de Registo Predial”,

- Check that the property is free of heirs, if there is no rental contract or usufruct by a third party. You can also obtain this information from the “Conservatório do Registo Predial”,

- Check that the IMI(which is payable annually) is up to date at the time of purchase.

As far as plans are concerned, it may be useful to check with the town hall that… :

- The construction is legal,

- The property is licensed(licença de utilização),

- Check that all annexes, swimming pools, terraces, etc. have been approved. This will avoid the surprise of buying a property with work to be legalized, such as a swimming pool, terrace, etc. without a permit, which can become a real problem the day it is discovered, leading to additional costs for obtaining a permit, or even demolition in some cases. Note that the law stipulates that any property built before 2004 must be documented by a “fiche technique” describing the declared installations.

If you’re not comfortable with these procedures, or if you don’t speak Portuguese, it may be useful to have a French-speaking lawyer accompany you.

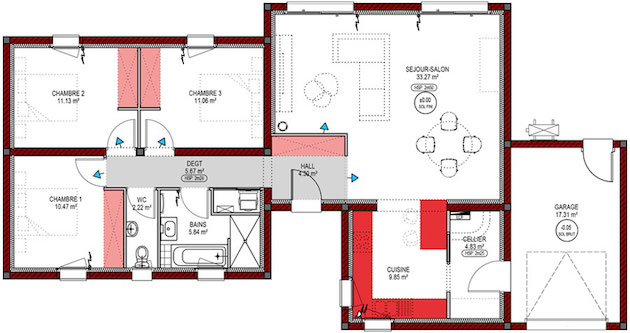

Plan of a property.

3. Verification of the interior and exterior condition of the house

It’s very important to identify pathologies in the interior and exterior construction of your home. Changing a floor or painting a wall is no big deal, but infiltration and damp problems, for example, are more complicated to resolve and can sometimes prove costly. That’s why it’s important to check the exterior, common areas and interior of your property to avoid any surprises.

Be on the lookout for cracks, traces of damp, missing tiles (if any) and the state of water and electricity installations. If in doubt, it’s advisable to call in a professional to check before buying. I’d like to emphasize the problems of damp/infiltration, as they are fairly recurrent in properties in Portugal.

Dampness on the walls.

4. Check the viability of your construction/renovation company

If you’re considering buying a property in Portugal off-plan, or renovating it, it may be wise to check a few points about the construction/renovation company you’re considering:

- or buildings already built by the builder to see the results and quality of the work,

- <check the=”” viability<=”” strong=””> of the construction/renovation company: has it been in the market for a long time? Do I have any customer feedback? etc.</check>.

- Check the guarantees offered by the company. In principle, a new build comes with a 5-year construction warranty,

To find out more about renovation in Portugal, read this article: Renovation in Portugal, how does it work?

5. Before you buy, plan a budget for monthly charges and expenses

To avoid unpleasant surprises, it’s important to budget carefully for the monthly charges and expenses you’ll have to bear. These include

- Water, electricity, gas, TV, internet, etc. Note that in Portugal, electricity and TV/Internet subscriptions are more expensive than in France. I would stress the importance of budgeting for electricity, as many homes do not have central heating, but use electric heating or reversible air-conditioning, which generates high electricity costs. Also, the price of electricity is higher in Portugal(average price per kilowatt-hour in 2018 for individuals: €0.18 incl. VAT in France vs. €0.23 incl. VAT in Portugal),

- Loan repayments, if you have taken out a mortgage,

- Insurance: life insurance, home insurance,

- Condominium fees, if you live in a condominium. Please note that many condominiums offer a host of facilities and services, including green spaces, swimming pools, gyms, saunas and steam rooms. This is a good thing, but it can quickly drive up the cost of a condominium. So don’t forget to factor them into your budget.

- Etc.

To find out more about the cost of living in Portugal, read this article: Cost of living in Portugal: what budget do you need?

Monthly charges and expenses.

6. Property tax budgeting

In Portugal, the property is transferred to a notary or land registry office called a“casa pronta”, which confirms the accuracy of the documents relating to the purchase of the property in Portugal and ensures payment of the corresponding taxes, of which there are three: IMT, IMI and Imposto do selo :

- IMT (Imposto Municipal sobre a Transmissão Onerosa de Imóveis) : This is the municipal tax on the transfer of real estate. The calculation of the IMT is based on the higher of the following two values: the taxable asset value of the property or the value declared in the deed of sale. The higher of these two values is subject to an annually fixed rate. IMT must be paid to the notary at the time of the deed of sale(usually by “multibanco” card, if you don’t have one – ask in advance if a bank transfer is possible). Please note that there is an exemption from IMT when the value of the property is less than €92,407(on mainland Portugal). The amount of ITM varies between 0% and 8% of the purchase price. To simulate your IMT, click on this link.

- IMI (imposto municipal sobre imoveis): This is the equivalent of the French property tax (taxe foncière) and housing tax (taxe d’habitation) combined. IMI is paid annually by property owners in Portugal. It is calculated on the basis of the property’s taxable value. The rate of IMI is set annually by the municipality where the property is located(generally between 0 and 0.5% of the property’s value).

- Stamp duty (imposto de selo) on the transaction: 0.8% of the sale value of the property, included in the deed of sale.

Other costs include

- Property valuation (avaliação do imóvel), which is compulsory if you take out a loan. Before granting a loan, the bank carries out a valuation of your home by an expert, who estimates the value of the property. The cost of the appraisal varies from bank to bank, but is generally between 200 and 400 euros.

- Registration fees paid to the notary or land registry office. These cost around €700.

Property taxes.

7. Property price and loan negotiations

Negotiating the sale price: It’s a bit of a mouthful, but don’t hesitate to negotiate the sale price of the Portuguese property you’re interested in. You can expect to negotiate between 1% and 5% depending on the value of the property(% given as an indication).

Credit negotiation: Another obvious point is that if you take out a loan, take the time to compare several banks to get the best deal. Most Portuguese banks will grant a loan of more or less 75% of the purchase price for non-residents, after which it obviously depends on your profile and guarantees. To help you, find a mortgage simulator here.

Negotiating with the bank.

8. Insurance planning

When it comes to insuring your property in Portugal, there are two main types of compulsory insurance:

- Fire insurance (seguro de incêndio) : against the risks of fire, explosion, storm, electrical hazards…

- Life insurance: compulsory for those taking out a loan.

Optional insurance includes :

- <internal insurance=”” (<em=””>seguro de recheio), which protects furniture and possessions inside the home.</insurance>

Home insurance.

9. Some differences between real estate in France and Portugal

Typology: in Portugal, a T2 apartment is a two-bedroom apartment, whereas in France, it’s a one-bedroom apartment. In Portugal, it’s simple: the number corresponds to the number of bedrooms in the property: T1 = 1 bedroom, T2 = 2 bedrooms, T3 = 3 bedrooms, etc.

In terms of metrage: In Portugal, there is no Carrez metrage. As a result, parts of the dwelling under slopes, 50% of the walls, and storage spaces such as closets are counted in the metrage. The garage is not considered a “useful” surface, but can sometimes be included in the surface area presented by estate agents.

Diagnostics: Unlike France, Portugal has no compulsory diagnostics for lead, asbestos, termites, flooding, seismic risks, etc. The only compulsory diagnostic is the energy diagnostic. The only compulsory diagnosis is the energy diagnosis. The only compulsory diagnosis is the energy diagnosis.

10. Investing in seasonal rental

If you’re buying a property to rent out on a seasonal basis, check the following points before you buy:

- Check that seasonal rental is permitted in the area where you wish to buy the property. In Portugal, seasonal rental is becoming increasingly regulated. In Porto and Lisbon, for example, city councils no longer issue seasonal rental permits in certain neighborhoods,

- Check that seasonal rentals are permitted in your property. If a majority of the owners of your property have voted “no” to seasonal rental, you won’t be able to do so,

- Simulate the possible rental yield. Click here to discover a simulator that can help you do this,

- If you’re not on-site, you’ll also need to factor in seasonal property management agency fees. In general, these companies charge 25% of the reservation amount.

To find out more about vacation rentals in Portugal, read this article: Holiday rentals in Portugal in 8 questions

In conclusion

Buying or investing in property in Portugal is possible for everyone. However, like any property purchase, it requires research and preparation. If you don’t speak Portuguese or English, I strongly recommend that you seek assistance in your search for and purchase of property in Portugal, to avoid any misunderstandings and/or unpleasant surprises. In recent years, many agencies have specialized in property searches for French speakers, so you can easily find a Franco-Portuguese agency to accompany you in your search for property in Portugal.

Ready to buy property in Portugal?

If you liked this article, please share it by clicking on the “Share this article” tab below. And welcome to our social networks:

- Facebook Group -> ; “Amoureux du Portugal” (Lovers of Portugal),

- Facebook Page -> ; “Vivre au Portugal” (Living in Portugal)

- Instagram -> ; “Living in Portugal”

Receive the latest blog posts and our selection of properties every month.

* required fieldFirst name * *Last nameTelephone Email address * *Current city of residence Area of interest :*

- Buying a property in Portugal

- Rent a property in Portugal

- Nothing special in mind

Date of arrival in Portugal How can we help you? * * Please contact me *

- Quickly please

- Please contact me later

Region of interest *

- Almada

- Aroeira

- Seixal

- Setubal

- Others

You can read our Privacy Policy and Conditions here

Articles Populaires

dernières annonces

2 bedroom apartment with sea view, 10km from Lisbon and 2km from the beaches

Rua da Bica, 103Discover this magnificent 2 bedroom apartment with views of Arriba Fóssil and the sea, 2km…

Duplex apartment with sea view 15 minutes from Lisbon

rua Santa Teresa 7Bedroom + duplex apartment with sea view and 15 minutes from Lisbon.

Single-storey house with swimming pool

Just a few meters from the magnificent bay of São Martinho do Porto, lies this…

Condominium apartments facing the sea

São Martinho do PortoBeautiful apartments in São Martinho do Porto “Janela da Baía”! Located in the heart of…

Villa already finished and ready to move in: 4-suite bungalow on 750m2 plot in a quiet area of Azeitão

Rua de ParisHouse already finished and ready to move into! Close to shops and services, quick access…

Magnificent house with basement, indoor and outdoor pool in Verdizela/Aroeira

Verdizela/AroeiraNew turnkey project: magnificent single-storey villa, 498m2 in surface area, high-end finishes on a 1875m2…

House T3 1 10 min from Lisbon and 5 min from the beaches

PêraREADY TO MOVE IN! New T3 1 ready-to-live-in house in a quiet, rural neighborhood with…

4 bedroom villa with pool and jacuzzi in Aroeira

rua são miguelModern, minimalist architect-designed house with exceptional details in a quiet location in Aroeira 2-storey house…

House with pool ready to move into

Verdizela/Aroeira

Inscrivez-vous à notre newsletter

Recevez chaque mois les derniers articles de notre blog "la vie au Portugal" et notre sélection de biens immobiliers à vendre.