8 questions and answers about health insurance in Portugal

![]()

Insuring yourself against the various risks of everyday life should always be one of the first things to do when moving abroad. And health insurance in particular! Today, Christophe Antone from MDS Expat(insurance broker) answers 8 questions about health insurance in Portugal.

Christophe Antone, MDS Expat

Also, if you’d like even more answers and details on health insurance in Portugal, I invite you to read or reread the very comprehensive article Virginie wrote on the blog.

1. What isMDS Expat‘ s business in a nutshell?

MDS Expat insures French-speaking expatriates in Portugal. They are brokers, which means they work with several of Portugal’s leading insurers, enabling them to compare and select the insurer best suited to your needs. They offer insurance solutions at different levels.

MDS Expat’s services are free of charge. As in France, as brokers they are remunerated by the insurance companies. The rates charged are therefore those of the insurance companies.

2. How is the social protection system organized in Portugal?

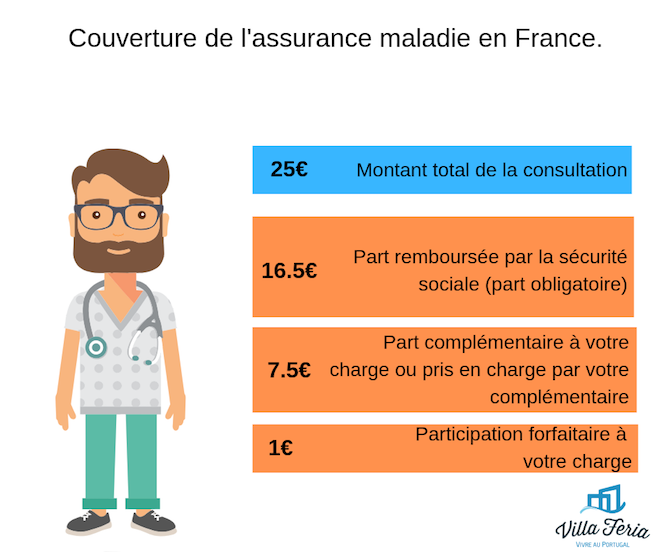

In France, health insurance(social security) and complementary health insurance(assurance santé or mutuelle santé) provide access to private and public services. The table below clearly shows the two levels of coverage: health insurance and complementary health insurance.

In Portugal, there is only health insurance coverage(social security). There are no supplementary schemes to top up reimbursements, as is the case in France. Portuguese social security only covers expenses incurred in the public sector, not those incurred in the private sector. The remainder of the cost to be covered by Portuguese social security beneficiaries(the ticket modérateur) is fairly low. For example, for a consultation with a general practitioner, you pay 4.5 euros. For a consultation with a specialist, you pay 7 euros.

The public and private sectors are totally independent of each other. The private sector is only accessible with private health insurance.

3. Why take out private health insurance in Portugal?

As we’ve seen, private health insurance gives you access to private healthcare services in Portugal, which can be very attractive when you consider the waiting times in the public sector. Indeed, apart from major emergencies, waiting times in the public sector are extremely long, whereas those in the private sector are almost immediate. Waiting times for an appointment with a specialist or for an operation are so long that many people opt for private health insurance to benefit from faster care in the private sector. But what does “extremely long” mean? Well, it’s not easy to give a timeframe, because it depends on the city you’re in, the hospital, the specialist you’re going to see, and so on. But it generally takes three months for an appointment with a specialist. The national objective is to keep this to a maximum of eleven months.

Also, when it comes to choosing your doctor, in the public sector you can’t choose, whereas in the private sector you can.

4. How do I take out private health insurance in Portugal?

You can take out private health insurance in Portugal as soon as you settle in, as it is not linked to whether or not you have Portuguese social security. The contract is simply taken out according to age, needs and the private networks to which the person wishes to have access.

As a broker, MDS Expat has access to all insurance companies, and offers the best solutions according to various criteria, the main one being the age at which the policy is taken out.

5. Is it easy to find French-speaking doctors in Portugal?

Each private healthcare network offers a directory by specialty and geographical area. This allows you to quickly identify the practitioner closest to your home. You won’t always find doctors who speak French, but many Portuguese doctors are at least bilingual and speak French or English in addition to their native tongue.

6. Do I keep my French social security rights if I live in Portugal?

It depends. It depends on whether you’re working or retired.

If you are retired,you retain your French social security rights by completing form S1. You can therefore maintain your social security in France, and at the same time open up your Portuguese social security rights. In the end, retirees have access to both compulsory schemes. So, if you return to France for medical treatment, your French social security system will continue to work, and you can use your carte vitale.

If you’re working, you won ‘t retain your French social security rights unless you’re on secondment(your French employer sends you abroad and agrees to pay contributions to the compulsory French system). Apart from this case, as an active employee, you will be covered solely by the Portuguese social security system. If you absolutely must maintain a link with French social security in addition to the local system, you will need to subscribe to the Caisse des Français de l’Etranger (CFE).

7. Can I use the European Health Insurance Card (EHIC) if I live in Portugal?

No. The EHIC is intended exclusively for short stays and vacations in the EU. It does not work for residents of Portugal. As mentioned above, if you live in Portugal, you must use the Portuguese social security system for the public sector, and private health insurance if you wish to access private healthcare networks.

8. Are my spouse and/or children covered by the private health insurance in Portugal that I have taken out for myself?

No, spouses and/or children are not beneficiaries of your private health insurance. The insurer only covers the person who has taken out the policy.

However, you should know that most insurers offer sliding-scale rates when more than one person is insured. Discounts range from 5% to 20%, depending on the insurer and the number of people insured. For example, you can expect an average 10% discount for a couple.

If you would like further information, or to request a quote from MDS Expat, please fill in the form below:

* indication requiredFirst name Last name Email *Phone

[tcb-script type=”text/javascript” src=”//s3.amazonaws.com/downloads.mailchimp.com/js/mc-validate.js”][/tcb-script][tcb-script type=”text/javascript”](function($) {window.fnames = new Array(); window.ftypes = new Array();fnames[1]= ‘FNAME’;ftypes[1]=’text’;fnames[2]=’LNAME’;ftypes[2]=’text’;fnames[0]=’EMAIL’;ftypes[0]=’email’;fnames[4]=’PHONE’;ftypes[4]=’phone’;fnames[3]=’SOURCE’;ftypes[3]=’text’;}(jQuery));var $mcj = jQuery.noConflict(true);[/tcb-script]

In conclusion

People who don’t get sick very often, have no particular health concerns, have no planned short-term interventions and are not a priori “at risk” can assume that Portuguese social security, which provides access to the public, is sufficient.

But beware! However, in my experience, it doesn’t just happen to other people, and it’s better to have taken the necessary steps in terms of insurance when it happens to you! Without going into too much detail, I’m lucky enough to be a healthy person who “never” gets sick. And yet! 4 years ago, without any warning signs, I had to undergo several major operations in Portugal due to a health problem. Fortunately, I had my private health insurance in Portugal, without which the delays for my operations and reimbursements in the public sector would have been quite different. I’m not saying you absolutely have to take out private health insurance in Portugal, but I highly recommend it.

In terms of price, as we didn’t mention “price” in the article, you need to get a quote, as prices vary widely depending on your profile and needs. Criteria include:

- your age,

- the level of cover you want,

- whether you want coverage only for Portugal, for Europe, for the rest of the world, etc.

Are you thinking of taking out private health insurance in Portugal?

If you liked this article, please click on the “Like” button below. And don’t forget to follow us on our social networks: our Facebook group “Amoureux du Portugal”, our Facebook page “Vivre au Portugal” and our Instagram “Vivre au Portugal”.

Receive monthly updates on our blog and our selection of properties for sale

* mandatory fieldFirst name * *Last name Telephone E-mail address * *Current city of residence Focus: *

- Buying a property in Portugal

- Renting a property in Portugal

- Nothing special in mind

Date of arrival in Portugal How can we help you? * * Please contact me:*

- Quickly please

- Later please

Region of interest *

- Almada

- Aroeira

- Seixal

- Setubal

- Other

You can view our Privacy Policy and Termsand Conditions here

Articles Populaires

dernières annonces

2 bedroom apartment with sea view, 10km from Lisbon and 2km from the beaches

Rua da Bica, 103Discover this magnificent 2 bedroom apartment with views of Arriba Fóssil and the sea, 2km…

Duplex apartment with sea view 15 minutes from Lisbon

rua Santa Teresa 7Bedroom + duplex apartment with sea view and 15 minutes from Lisbon.

Single-storey house with swimming pool

Just a few meters from the magnificent bay of São Martinho do Porto, lies this…

Condominium apartments facing the sea

São Martinho do PortoBeautiful apartments in São Martinho do Porto “Janela da Baía”! Located in the heart of…

Villa already finished and ready to move in: 4-suite bungalow on 750m2 plot in a quiet area of Azeitão

Rua de ParisHouse already finished and ready to move into! Close to shops and services, quick access…

Magnificent house with basement, indoor and outdoor pool in Verdizela/Aroeira

Verdizela/AroeiraNew turnkey project: magnificent single-storey villa, 498m2 in surface area, high-end finishes on a 1875m2…

House T3 1 10 min from Lisbon and 5 min from the beaches

PêraREADY TO MOVE IN! New T3 1 ready-to-live-in house in a quiet, rural neighborhood with…

4 bedroom villa with pool and jacuzzi in Aroeira

rua são miguelModern, minimalist architect-designed house with exceptional details in a quiet location in Aroeira 2-storey house…

House with pool ready to move into

Verdizela/Aroeira

Inscrivez-vous à notre newsletter

Recevez chaque mois les derniers articles de notre blog "la vie au Portugal" et notre sélection de biens immobiliers à vendre.